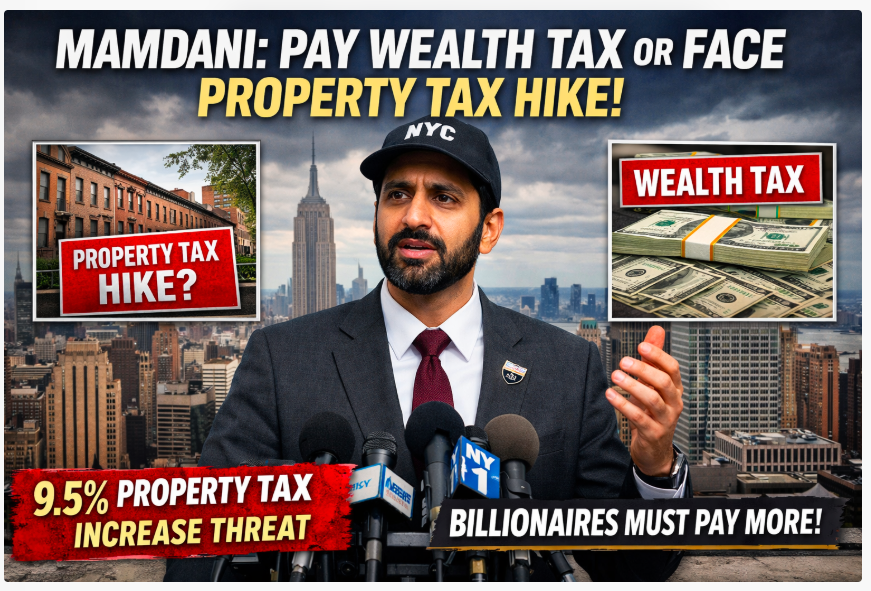

New York — In a dramatic escalation of fiscal tensions between City Hall and Albany, New York City Mayor Zohran Mamdani on Tuesday unveiled a preliminary budget proposal that hinges on an unprecedented 9.5 percent increase in property taxes — a measure he says would be deployed only if state lawmakers refuse to approve new taxes on the wealthy and corporations.

Mamdani, a Democratic socialist who took office in January, framed the massive property tax hike as a “last-resort” option in response to what he calls a structural budget imbalance facing the city. His $127 billion preliminary budget plan, set to take effect July 1, projects a $5.4 billion deficit and attempts to pressure the state government into passing higher taxes on top earners.

The political gambit has instantly sparked fierce debate across economic and civic circles, with critics warning that the burden will fall squarely on homeowners and potentially deepen New York’s affordability crisis. Even some Democratic City Council members have expressed reservations about the proposal.

State vs. City: A Fiscal Standoff

At a City Hall press briefing, Mamdani reiterated that the property tax increase would be used only if the state declines to enact higher income and corporate taxes on the wealthiest residents — a step he has championed since his mayoral campaign. The mayor said taxing the ultra-wealthy and large corporations represents the “fairest” solution to New York’s fiscal shortfall and accused previous administrations of underbudgeting essential services.

However, Governor Kathy Hochul — engaged in her own re-election campaign — has publicly rejected both the wealth tax and the property tax hike. “I’m not supportive of a property tax increase,” Hochul said at an unrelated event this week, insisting that deeper spending cuts and efficiency measures should be explored.

Analysts say that while the mayor is within his legal rights to propose a rate change, the political opposition from both state and local leaders suggests the idea may struggle to advance. City Council Speaker Julie Menin has called a large property tax increase “a non-starter,” warning that it would compound the affordability pressures already faced by working- and middle-class New Yorkers.

The Real Impact on New Yorkers

Property taxes are the largest source of locally controlled revenue in New York City and have not been raised in more than two decades. Still, a nearly 10 percent hike represents a dramatic departure from past fiscal practice.

Heads of small business associations and housing advocacy groups have warned that such an increase could be passed through to tenants in the form of higher rents, negatively affecting affordability. The New York Apartment Association and other critics argue that even with rent-stabilization freezes, landlords will face untenable tax burdens.

From a conservative fiscal viewpoint, the proposal raises fundamental questions about economic competitiveness. A report by the Partnership for the City of New York suggests that high taxes on wealth and business could accelerate the exodus of jobs and investment to lower-tax states like Texas — a dynamic already cited by many economists observing trends in domestic migration.

City’s Budget History and Mamdani’s Rationale

Mamdani’s proposal includes aggressive revenue assumptions and withdrawals from reserve funds, a combination that some fiscal watchdogs call risky. New York City Comptroller Mark Levine described the strategy as “pretty extreme” and warned that reliance on such measures without structural reforms could leave the city vulnerable to future shortfalls.

Mamdani’s administration recently claimed that record Wall Street bonuses and unexpectedly high income tax revenues have narrowed the gap, but these gains are not considered sustainable long-term solutions.

By presenting lawmakers with what many observers describe as an ultimatum — tax the wealthy or tax property owners — Mamdani appears to be attempting to shift Albany’s budget calculus. But critics counter that using tax increases as leverage undermines responsible governance and places undue risk on everyday property owners and businesses.

Political Ramifications

Republicans and fiscal conservatives have seized on Mamdani’s proposal as evidence of ideological overreach. U.S. Rep. Nicole Malliotakis, a vocal opponent of the property tax increase, sharply criticized the plan for making homeownership less attainable and deterring economic growth.

Local political strategists note that Hochul’s rejection of the wealth tax places her at odds with the mayor’s agenda, a dynamic that could shape upcoming state budget negotiations and influence voter perceptions in the 2026 midterms.

X Posts

📹 Video: Mamdani Budget Press Conference — Mayor Mamdani outlines the two paths to balance the budget: wealth tax or property tax hike. (Embed video from WNBC / NBC New York)

🗨️ X Post:

“The choice is clear: tax the wealthy or face property tax increases and reserve fund withdrawals.” — @NYCMayor (February 17, 2026)

🗨️ X Post:

“Governor Hochul: No property tax increases necessary. Let’s find what truly balances the budget.” — @KathyHochul (February 17, 2026)

Looking Ahead

The final budget negotiations will unfold over the coming months, with state legislators, the governor’s office, and City Hall holding considerable leverage. If Albany refuses wealth tax legislation, New York City homeowners could face the most significant property tax increase in decades, with serious implications for housing markets and economic vitality across the region.

Clickbait Title Options (≤7 Words)

-

Mamdani Threatens 9.5% Tax Shock

-

NYC Homeowners Could Face Huge Tax Hike

-

Wealth Tax Standoff Could Crush Property Owners

10 High-Value Keywords

-

Mamdani property tax increase

-

New York City budget crisis

-

wealth tax ultimatum

-

Hochul tax opposition

-

NYC fiscal policy

-

budget gap solutions

-

property tax hike impact

-

economic competitiveness

-

tax burden debate